For cryptocurrency holders, their high volatility (the average volatility of the US stock market is 17%, while the average volatility of Bitcoin and Ethereum is around 55%) can cause some concern. Of course, the cryptocurrency segment is in the early stages of development from a consumer perspective and mainly consists of early adopters. However, to move to the next qualitative level, certain transformations will be required, one of which is the ability to receive fixed income from one’s assets.

If we turn to the traditional financial market, there are four ways to get fixed income:

- Bank deposit — this option assumes minimal returns, but maximum protection against risk.

- Buying bonds (government and corporate) — this option offers higher returns, but is also associated with increased risk (companies or governments may fail to repay the debt).

- Buying stocks that pay dividends — this option offers higher returns than bonds but is also associated with even greater risks (in case of default by the dividend-paying company, shareholders may lose their investments). One way to reduce the risks associated with buying dividend-paying stocks is to invest in ETFs (for example, those that track “dividend aristocrats,” i.e., companies with a long history of never reducing or canceling dividend payments).

- Structured products. A structured product is a combination of fixed income and a derivative. Fixed income can be obtained through a deposit or bond, or through interest rate options. The derivative part typically includes options that describe the goals of a particular strategy (for example, capital protection, participation in market movements, etc.).

Let’s consider the opportunities the cryptocurrency market offers in terms of conditionally stable income. It is called conditionally stable because protocols do not guarantee a specific level of return. Only time will show what returns they can actually offer. The most similar to deposits are liquid staking and lending.

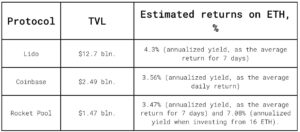

Let’s start with liquid staking. On the Ethereum network, there are 23 protocols providing this service based on DefiLlama data. 95% of all assets are concentrated in the top 3 solutions (listed below).

As we can see, the stated return always represents some average return for a certain period. Let’s move on to lending protocols.

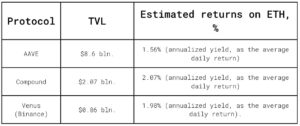

In lending protocols, the situation with returns is similar or even lower than in liquid staking protocols. This is due to the fact that the returns of liquid staking protocols are determined by the economy of Ethereum, while the returns of lending protocols are determined by the economy of the protocol itself.

Today, in the cryptocurrency market, we can get a certain “guaranteed” return from 1.5% to 7.1% per annum on Ethereum. However, this “guaranteed” return is a kind of average value and is earned in Ethereum or the underlying asset, rather than in the corresponding currency, as it happens in traditional finance, for example, when paying dividends on a share or coupon income.

It is worth noting separately that returns on Bitcoin are significantly lower. For example, on AAVE lending, the return on Bitcoin is 0.16% and is also not fixed but yield to maturity, as the average daily return.

The fixed-income instrument segment, which is the cornerstone of the financial sector, is entirely absent from the cryptocurrency market. There are no protocols with a product, clients, and at least minimal revenue yet. The experience of Lido and AAVE shows that a 1–2% increase in returns leads to a rapid flow of clients in favor of the protocol with higher returns. It can be expected that fixed-income protocols will become mainstream in the medium-term perspective.