At the moment of correction, altcoins mostly fell by an average of 10-17%, later recovering a small rebound in price. In fact, there was a correction, about which we repeatedly warned and wrote. It is worth to watch even more closely how the market situation will develop further.

After the Fed’s rate meeting, where the current rate of 5.5% was maintained, some analysts believe that the Christmas rally is still ahead. And a correction is possible a little later, in which the market could go down 20-30%, despite the expected positivity in January in the form of theoretical ETF approvals. But investors are best advised not to rely on luck and protect their funds now ?

BUY a protective product with 0.1% APR. Why should you buy it now? Because by buying now, you are buying insurance that your investment will not go down in a sharp market move downwards, especially if you are trading with shoulders.

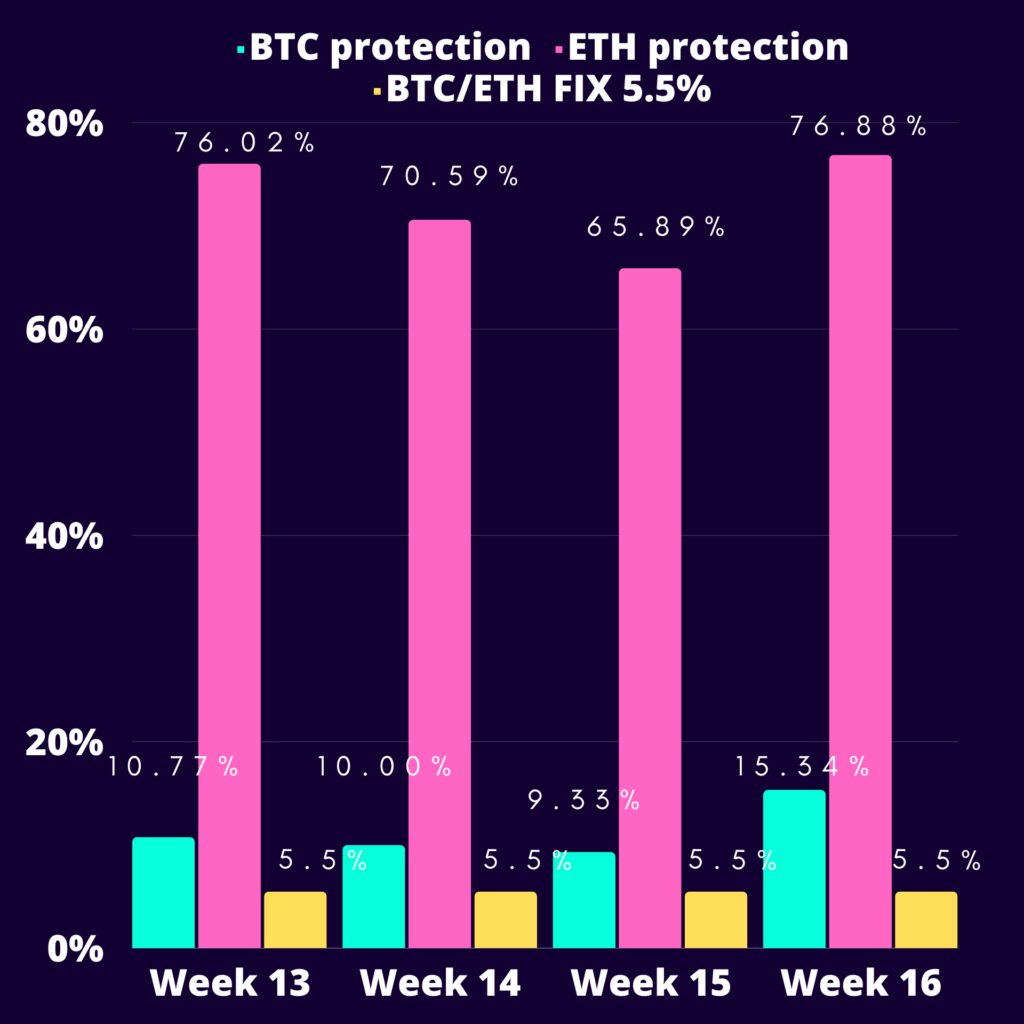

Below is a weekly retrospective review of the potential returns from possible participation in structured products from yieldfort.com ?

Two products launched:

? 5.5 % fixed return.

No matter what the price of BTC or ETH is, you are guaranteed to get 5.5% per annum in BTC/ETH.

? BTC/ETH capital protection

The greater the movement in the price of the coins, the greater the return in $.

For example, if when you invested BTC or ETH on August 25 (platform launch), you would have received a return (in % APR) at the current moment on December 15:

? for BTC +15.34%

? for ETH +76.88%

?️ Annualised returns by week on the chart ?

? Join YieldFort, get fixed returns and capital protection